Blog

The Human Side of Finance: Support, Simplicity, and Growth

Writing has always been one of my first loves (before bookkeeping ever found me), so this space is extra special to me. It’s where I get to combine that love of words with my passion for helping small businesses and nonprofits make sense of their numbers. You won’t find stiff, boring finance talk here, just down-to-earth tips, stories, and guidance to make bookkeeping feel a little lighter and a lot more doable. Thanks for being here, I’m so glad we get to share this space together.

Dialed-in. Real.

Creative.

Flexible.

Bacon, Brie, and Balance Sheets

Hi Friends!

Today we are going to dive into your balance sheet. Every business owner should understand the basics of the balance sheet, but let’s be honest the whole concept can feel tricky.

A balance sheet, also called the statement of financial position, shows what your company owns, owes, and what the owner has invested in or withdrawn from the company as of a specific date. Wowza, that’s a mouthful. Let’s break down each section into bite-sized, tangible chunks and then bring it all back together.

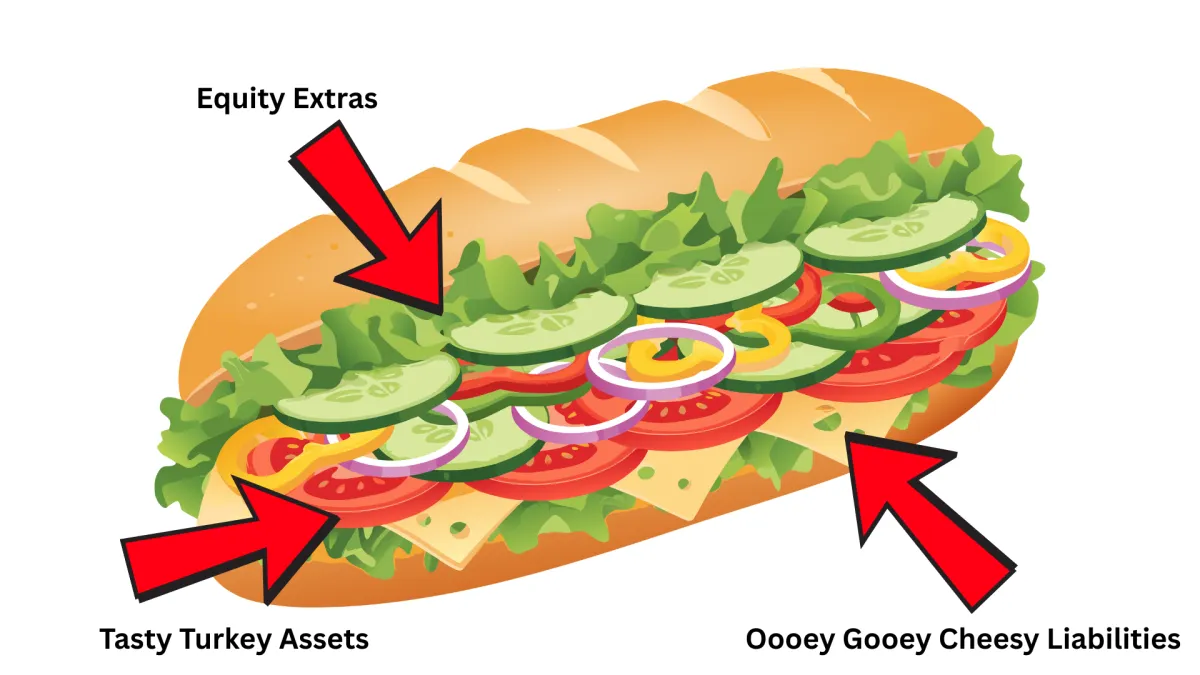

Confused, about the picture above? Read on to find out what a balance sheet and a freakin- mouth watering turkey sub have in common.

Assets – What You Own

If the balance sheet is a delicious turkey sub sandwich, the meaty flavorful base of the sandwich is the assets - what the company owns.

What does the company have claim over? What does the company have the rights to use and operate?

Common types of assets for small businesses include:

Cash

Checking accounts

Buildings

Vehicles

Inventory

Accounts receivable (what your customers or clients owe you)

Liabilities – What You Owe

Now, to balance out what you own, we have to consider how the company acquired those things.

Let’s say you’re just starting out and you need a building for the company. You need to purchase a building to operate from. How can we fulfill this purchase? Well, the company could take out a loan to buy the building, or the owner could invest their own money to purchase it.

The liabilities are like the rich inviting cheese on your sub. They add flavor and hold everything together, but too much and the sandwich gets messy. Same with liabilities. They can help you fund your business and purchase assets like inventory, but you want to keep them under control.

Common examples of liabilities include:

Loans

Credit cards

Owner’s Equity – Your Investment

Owner’s equity is the delicious toppings of the sub. Mmm, add some mayo, some bacon, some banana peppers. Man, this is making me hungry!

Owner’s equity is how much the owner has invested of their own personal money to get the business going, and how much has been taken out. For example, if you use business funds to pay your personal taxes, that counts as an owner withdrawal and reduces your equity.

Net Income & Retained Earnings – The Finishing Touches

You will also notice two other lines in your owner’s equity section: net income and retained earnings.

These words might sound intimidating, but trust me - they’re not, once you understand them.

Net Income: Found at the bottom of the profit and loss report, this is what’s left after expenses for the month. That number gets pulled into your balance sheet.

Retained Earnings: The cumulative amount of earnings that hasn’t been withdrawn by the owner. The earnings retained or held in the company.

Pulling It All Together

Now that you’ve stacked your magnificent turkey sub, it’s time to press it together and take a bite! Just like every layer of a sandwich comes together to make the whole, every section of the balance sheet combines to give a full picture of your company’s financial health.

Your balance sheet helps lenders, creditors, future investors, and banks decide how much of a risk it is to work with you. An organized, detailed balance sheet makes their job easier and helps you stand out.

And just like you’d go back for another bite of that sandwich, we’ll return in a future post to explore other financial “ingredients” like the profit and loss report.

A balance sheet can feel overwhelming at first, but think of it as your financial sandwich - you want the right layers stacked neatly so every bite makes sense. If something still feels fuzzy after reading this, I’d be glad to chat. We offer two ways to work with us: our DIY support program if you’d like guidance while keeping the books yourself, and our monthly bookkeeping program if you’d prefer to hand it off completely. Either way, you don’t have to navigate this alone, we’re here to help.

Now go fix yourself a turkey sub, and we'll talk soon!

Hugs,

Emily

Let's get started!

Curious about how we work and whether we’d be a good fit? Let’s start with a quick 15-minute meet & greet! It’s a chance to connect, chat through what’s on your mind, and see if we click. From there, we can figure out the type of support that fits you best and book a full consultation call to dive deeper.

Curious about how we work and whether we’d be a good fit? Let’s start with a quick 15-minute meet & greet! It’s a chance to connect, chat through what’s on your mind, and see if we click. From there, we can figure out the type of support that fits you best and book a full consultation call to dive deeper.

Quick links

Services

© 2025 by Frankort Accounting

© 2021-2025 Northern Michigan Bookkeeping Services LLC | The information contained on this Website and the Resources are not intended as, and shall not be understood or construed as, financial, tax, legal or professional advice. The information contained on this Website is not a substitute for financial, tax, legal or professional advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided on this Website and in the Resources are accurate and provide valuable information. Regardless of anything to the contrary, nothing available on or through this Website should be understood as a recommendation that you should not consult with a financial or business professional to address your particular situation. The Company expressly recommends that you seek advice from a professional. Neither the Company nor any of its employees, owners, or contributors shall be held liable or responsible for any errors or omissions on this Website or for any damage you may suffer as a result of failing to seek competent financial or business advice from a professional who is familiar with your situation.